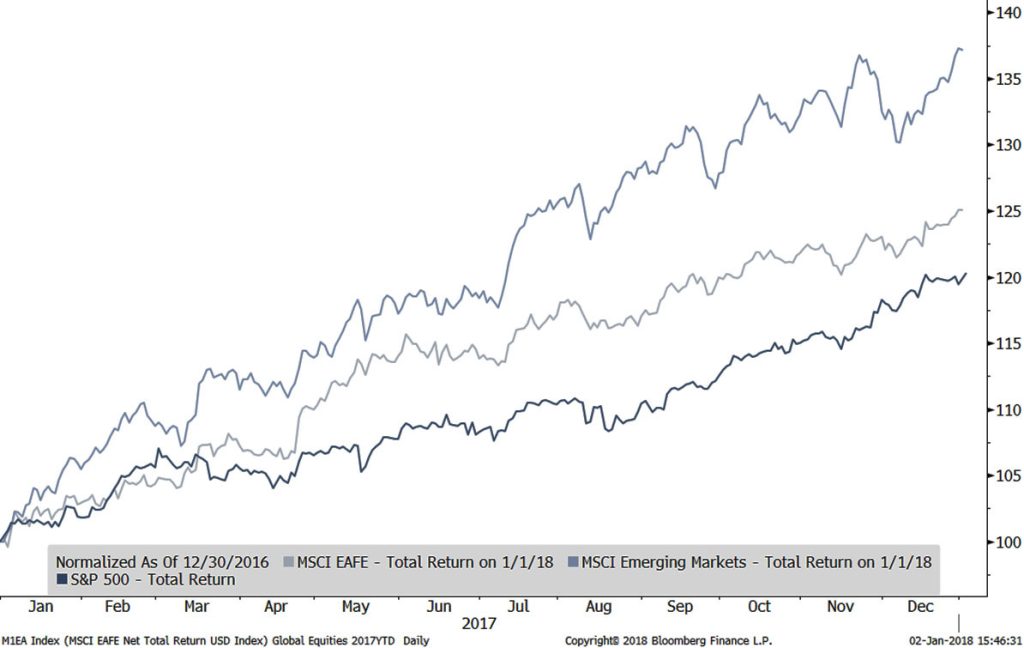

2017 was a very good year for market returns supported by the first year of simultaneous economic expansion in all three of the major economic blocks: Europe, China and the United States since the financial crisis. The S&P 500 rose 21.8%, and the MSCI All Country World Index rose 24.0%. International returns were particularly strong this year propelled by emerging market stocks which were up 37.3%. In 2016 we noted that, “we continue to recommend that investors take a global perspective, and invest in both U.S. and foreign companies. We are confident that international diversification will benefit investors over time.”

Corporate earnings growth has been particularly robust in overseas markets. This has underpinned the strong returns in international stock markets, and led to valuations remaining relatively attractive versus U.S. stocks. Despite the political theater, 2017 also saw very low economic and market volatility. Inflation remained below central bank targets, which allowed the Federal Reserve to continue with the very gradual interest rate hikes.

Market Returns for 2017

As markets have risen and become more expensive, we have been increasingly focused on durable investment themes that we believe will serve our clients well over the long term. We have discussed some of these themes in the past, noting in 2016 that, “we believe that water scarcity is attractive as a theme. Demand for water globally is expected to greatly outpace current supply. Water is a global theme, with opportunities in emerging markets as well as developed.”

Companies focused on water opportunities (e.g., purification, transportation, and efficiency) performed extremely well in 2017, with our designated water investment rising 27.1%.

Beyond water scarcity, we are increasingly focused on climate change as an investment theme. Companies are already responding to demands for more sustainable resource use. We see opportunities in water, agriculture, energy efficiency, and alternative energy. At the same time, we are further reducing our exposure to fossil fuels. China, now the world’s largest automobile market, is embracing electric vehicles as a means to combat urban pollution, and as an opportunity to leapfrog German, Japanese and American incumbents to develop a leading global automobile industry. China is also one of the major sources of lithium, a key ingredient in electric batteries, and is therefore well positioned to take the lead in battery production. As improvements in battery storage resolve the intermittency issues for wind and solar power, we expect fossil fuels to lose market share.

We wrote in 2015 that, “we believe that the markets are likely too negative about China’s short-term prospects, and fear has caused many investors to abandon emerging markets entirely.”

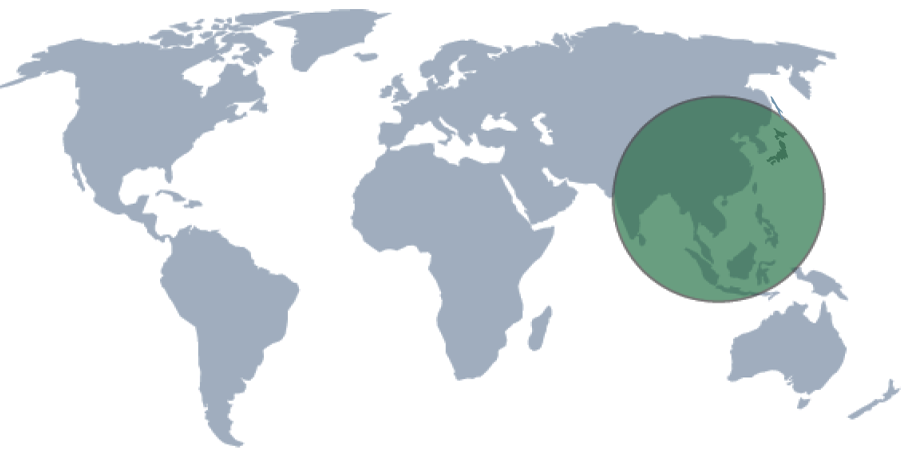

China’s strong economic growth continues. Nominal GDP growth increased from 6% to more than 10%, and corporate profit margins also rebounded. China sits at the heart of the world’s most populous region, where a new middle class is rising rapidly.

There are more people living inside this circle than outside of it

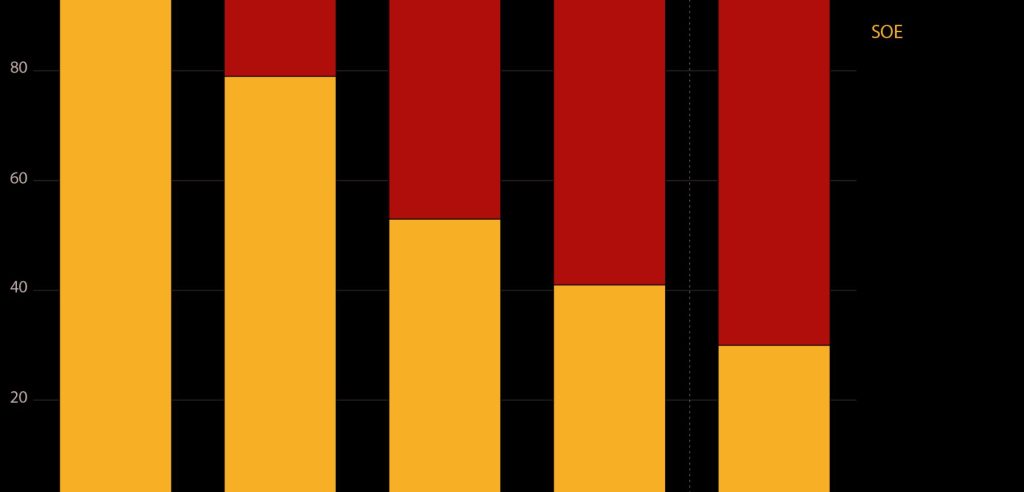

China’s stock market continues to evolve and deepen and is increasingly dominated by high growth firms in technology, healthcare and other innovation-led sectors who do not have heavy debt loads. The share of state owned enterprises (SOEs) has steadily declined over time. Spurred by a doubling of real income per average household over the past ten years, China’s household consumption is booming. For example, China’s adoption rate of mobile payment over the past three or four years has been unparalleled: just in 2016, China’s mobile payments hit $5.5 trillion, roughly 50 times the size of America’s $112 billion market, according to consulting firm iResearch. Investors are now in a better position to actually reap the benefit of the structural shifts in China and other growing Asian economies.

Composition of SOE and non-SOE companies in MSCI China (%)

Although we favored risk investments this year, we are mindful of several important risks. Despite unsettling headlines, political risks did not much affect the markets in 2017. This may not be the case next year. There are many, such as the possibility for increased trade friction, conflict with North Korea, or upcoming elections in Europe. As China continues to rise in influence, and with the U.S. in relative retreat, we are entering a more multi-polar and less stable world. Europe and the U.S. continue to struggle with low growth in average household income and, in the U.S., a marked increase in income and wealth inequalities. Technology and global trade have tilted the playing field away from labor. Average U.S. households have seen little or no growth in income over the past several decades. Millennials will soon become the dominant voting bloc in the U.S. These younger households will be more in debt and less wealthy than the older generations, and they will also be inheriting a large public debt. We think that these voters will ultimately push for more inflationary policies given that inflation benefits debtors and workers over creditors and retirees.

Federal Reserve policy action was key in mitigating the fallout from the financial crisis, and will continue to be vital to navigating future challenges. Jerome Powell is slated to become the new Chair of the U.S. Federal Reserve in February. With the transition at the Federal Reserve, it is unclear how the central bank will react to the next economic downturn. Wage growth in the U.S. is only 2.3%. This is a very low level from a historical perspective, and opens the door for a return of deflationary fears during the next slowdown. In four of the past seven recessions, the drop in the level of wage growth from its peak prior to the onset of a recession to its trough was more than 2.3%. This means that we could see negative wage growth during the next recession unless the Federal Reserve takes dramatic action.

We expect volatility to rise going forward. Please make it a New Year’s resolution to check the risk level of your portfolio to ensure that it remains appropriate for your goals. As always, we would be happy to meet at any time to discuss and review your portfolio.

Printable version.

Disclosures:

This presentation is for informational purposes and does not constitute investment advice, nor should it be considered a recommendation to purchase or sell any particular security. The opinions expressed are those of the Choate Investment Advisers (“ChoateIA”). Firm holdings for the last 12 months are available upon request. Investing involves the risk of loss of principal. Additional information about the risks can be found in Form ADV Part 2, which is available upon request.

ChoateIA is a registered investment adviser. Registration does not imply a certain level of skill or training. More information about the firm can be found in its Form ADV Part 2, which is available upon request by emailing info@choateinvestmentadvisors.com.