The United States is quickly changing its role in the world, and investors are struggling to adapt. The global economy is digesting a shocking increase in tariffs and trade friction. Equity markets were mixed in the first quarter of 2025; international stocks were up 6.9%, while the S&P 500 Index was down 4.3% as investors assessed the impact of the new Trump administration’s executive orders and expected tariffs. Bond investors are worried about both rising inflation and an economic slowdown; the Bloomberg aggregate bond index was up 2.8% as yields on new bonds declined.

President Trump’s April 2nd Tariff announcement shocked global markets with the size, speed, and potential duration of these import taxes. The S&P 500 Index declined by 12% in the first week after the tariff announcement and as of April 9th, the S&P was down 15% for the year. The announced Trump tariffs reverse 80 years of globalization.

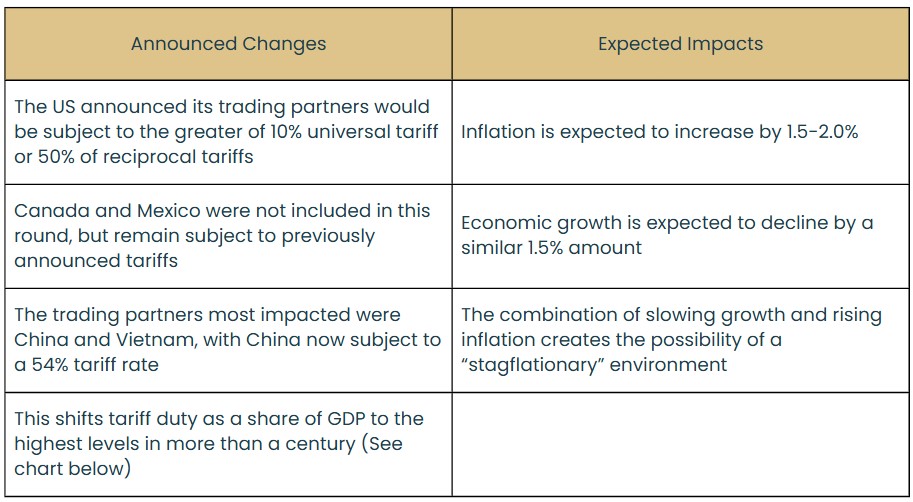

Let’s review the April 2nd announcement:

Please note this ongoing situation is chaotic and fluid, and there is no recent precedent, so reliable predictions are impossible. On April 9th, President Trump announced a pause on reciprocal tariffs for countries other than China, now 154% vs. 54% noted above in the April 2nd announcement, in response to growing pressures in credit markets. This 90-day pause alleviated some stress short term but increases policy uncertainty going forward. We expect that markets will continue to be volatile.

Chart 1: The speed and size of increased tariffs has been shocking

After several generations as the champion of free trade, the US is now moving toward protectionism. This abrupt shift will alienate our trading partners. In addition, the administration is voiding prior tariff agreements and effectively dismantled the General Agreement on Tariffs and Trade (GATT), which governed worldwide trade policies for eighty years. These actions will encourage retaliatory tariff policies unconstrained by an international framework. In fact, China immediately announced increased tariffs on US goods. While there is some potential for postponement or a partial rollback of some tariffs, it is likely that the post-World War Two era of free trade and global supply chains has come to an end, replaced with uncertainty and increased trade frictions.

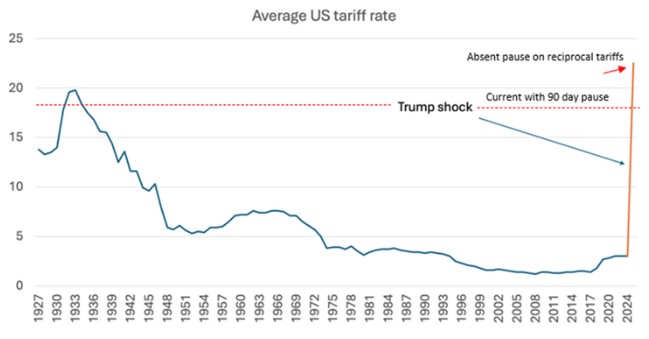

Even prior to the April 2nd tariff announcement, investors were concerned that tariffs would impair economic growth. First quarter earnings expectations are already declining (see chart below), and we expect this trend to continue.

Chart 2: Q1 2025 earnings estimates began to decline prior to April 2nd with room for more decline

In view of heightened uncertainty about global trade policies, investors will discount the future more heavily. This repricing of risk will lead to lower valuation multiples on future earnings. Before April 2 price/earnings multiples were well above average, and valuations may now head lower (as investors face the combination of lower visibility and lower earnings going forward).

Let’s take a closer look at how tariffs impact markets. Tariffs impose an additional cost on products. This cost is borne by one or more of the following three parties.

- The seller: Consider a company that obtains inputs from suppliers and then sells output to consumers. The company might absorb the higher cost from suppliers and not pass along any price increase to consumers. This approach would maintain unit sales but would hit the product company’s profit margins. Company earnings would decline significantly.

- The supplier: In some instances, the company may have enough buying power to force concessions on its suppliers. In an extreme case, the supplier might bear all the cost, leaving the seller and the consumer unaffected. Some suppliers with low margins will suffer under these circumstances. Also, many supply chains are clustered in foreign countries, and the US domiciled seller may struggle to negotiate against various suppliers.

- The consumer: In some instances, the company may pass along all the cost increase to the ultimate consumer, thus preserving product margins. However, the higher price will likely lead to lower demand and unit sales will decline. In this circumstance, the seller may see lower revenues, and consumers will make fewer purchases or cut back on other purchases to absorb these inflationary pressures.

In summary, the impact will vary by product and will likely be a blend of all three scenarios. In general, however, company earnings and consumer spending will be negatively impacted by less revenue, lower margins, and higher prices.

We can see that in general tariff taxes are both inflationary and a drag on economic activity. In addition, it may be difficult to plan around future policy changes. Will the tariffs be permanent, or will they be subject to multiple rounds of negotiation/retaliation? How might a business pick the location and timing of a future factory? It can take many years to move supply chains onshore. The following chart highlights how business confidence was already in retreat prior to the April tariff announcement. A decline in business confidence often leads to a slowdown in investment and hiring, spurring further consumer and economic weakness.

Chart 3: CEO’s confidence post in decline post inauguration

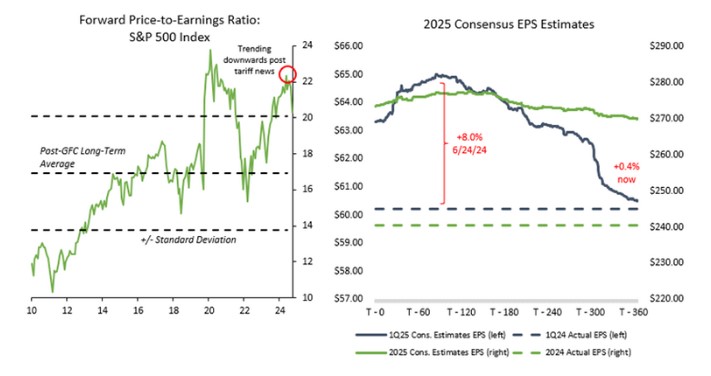

Let’s focus on leading indicators as we analyze the impact of these actions for the months ahead. The Leading Economic Indicators (LEI) index is a composite measure that predicts where the economy is going. This includes a blend of financial and non-financial components, as well as high frequency data and forward-looking surveys.

Chart 4: Leading economic index continues to trend down

We believe the LEI trend is more important than the absolute level. A decline signifies softening of future conditions, while an increase points to an improving economy. As we see above, the economy peaked in early 2022 and continues to decelerate from a high level.

What do the individual components of this index tell us? We highlight the ISM manufacturing ‘new orders’ component. This measure was pointing to contraction even before the April 2nd announcement.

Chart 5: ISM new order index points to future weakness

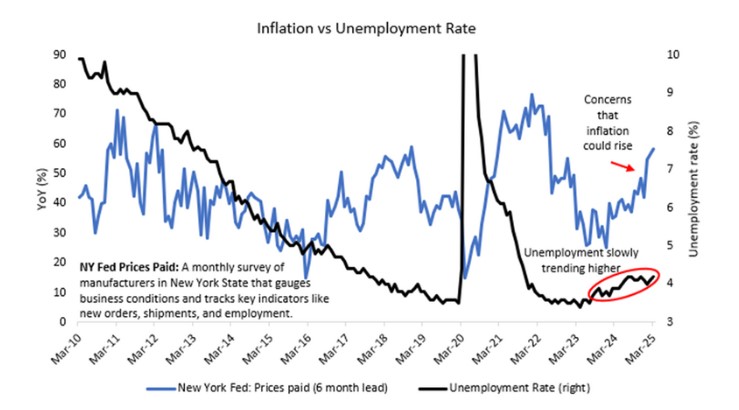

Even as investors factor in a slowdown in activity, we also see a risk of inflation, as noted in the chart below. Our biggest concern is the potential for a Stagflation environment — in which the economy stagnates at the same time as inflation rises.

Chart 6: An increase in price expectations and unemployment could signal “stagflation”

Investors are reacting to the most dramatic policy and governance changes since World War Two. Volatile markets can lead to investor error as fear can overwhelm analysis: there is a reason the term is “flight to safety” and not “a thoughtful stroll to safety.” When uncertainty is so high, it is often best to maintain your long-term strategy. Sudden, significant changes can lead to future disappointment as you don’t know what will happen in the future. With that said, we may, on your behalf, consider adjusting between stocks and bonds, and we may also consider adjusting between US stocks and international stocks. However, such decisions are made within the guidelines of your long-term strategy. It is too early to know when and where markets will settle, but we believe a balance of stocks and bonds will help clients navigate this turbulent transition.

We will be monitoring unemployment, inflation, corporate earnings, and key leading economic indicators.

We look forward to hearing from you, and updating you on your portfolio and on our outlook for the next year. Please reach out with any questions.

Best regards,

The Choate Wealth Team