Dear Choate client,

In our January update, we stressed that:

The market is reacting to recent changes in 1) the pace of the economic recovery, 2) rising inflation, and 3) the lingering effects of the COVID-19 pandemic.

The market is continuing to react to these factors. All observers expect that the Federal Reserve will shift policy to begin combatting inflation (by raising rates and possibly slowing the economy), and this has led many investors to re-assess the valuation multiples they were willing to pay for growth-oriented companies. These valuations were expensive and stretched.

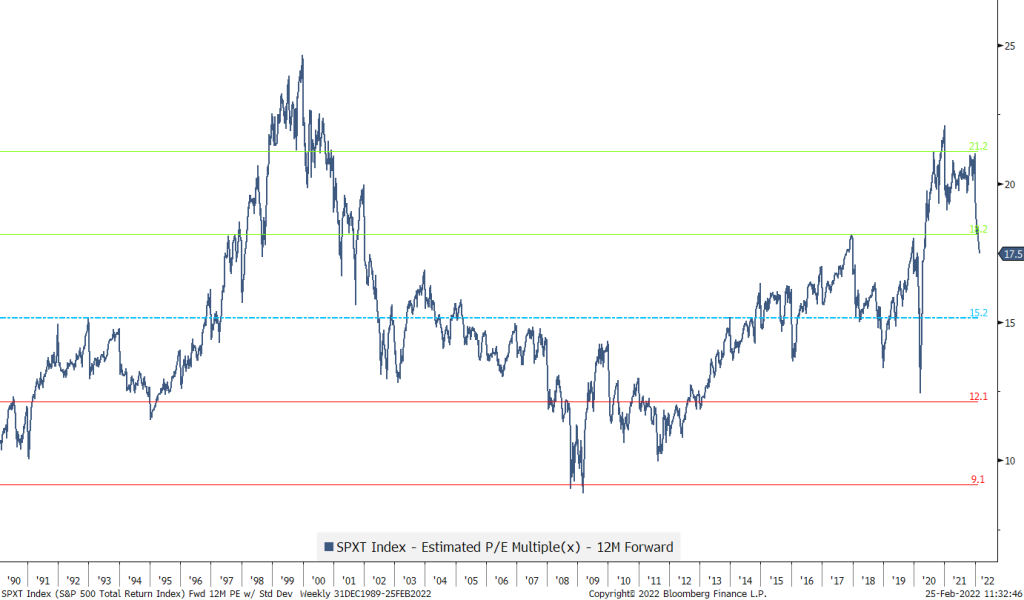

Inflation continues to be a major concern for investors fearing rising interest rates and cost pressures impacting corporate earnings. We have seen equity price to earnings multiples adjust downwards to reflect these concerns. As of 2/25/2022, the S&P 500 Index’s forward price to earnings multiples is down to 17.5X (see chart below). This is not “cheap” by historical standards, but relatively appropriate for a still positive economic backdrop.

In addition, 75% of S&P 500 companies have now reported Q4 2021 earnings above consensus estimates and the expected growth seems to be continuing for 2022. Forecasted aggregated 2022 earnings for the S&P 500 continue to rise and are now estimated at $223/share vs. $220/share at the end of 2021. At the same time, however, it is important to note that expectations for Q1 2022 have declined slightly from $52.5/share to $51.8/share. In essence, 2022 earnings have become slightly more back-end loaded and therefore more uncertain. Despite this important caveat, 2022 earnings still look quite robust with expected y/y growth of 8.6%. This is consistent with a “normal” year for the stock market.

Since mid-February, the Ukraine conflict has become a more significant driver of market performance. The long term fallout is still unclear and probably negative for global growth. However, the management teams of the companies you own appear to be performing reasonably well. This ability to adjust and reallocate resources — both when management adjusts at the company level, and when investors adjust at the capital allocation level — is an important adaptive feature of investing in stocks. Good companies have generally offered a resilient ability to survive volatile periods and thrive long term, and this is why equities remain a strong component of wealth creation and preservation.

We have taken steps to increase our overweight to US domiciled securities as the US looks relatively insulated from the Ukraine invasion, and importantly, US equities are more attractive today than a few months ago for the reasons outlined at the beginning of this letter. We reduced some international exposure, specifically to Europe, given the greater currency uncertainty and Europe’s reliance on Russian natural gas.

Please reach out to your portfolio manager if you would like a further conversation.

Sincerely,

Your ChoateIA team