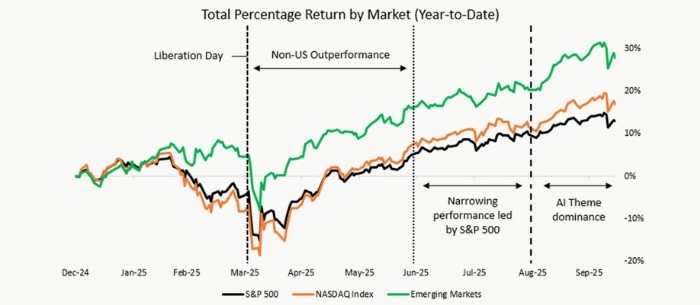

Markets moved higher last quarter, propelled by lower interest rates and strong corporate earnings, especially from AI-themed stocks. These two factors overwhelmed the ongoing economic concerns about tariffs, inflation, and softening labor markets.

The global stock market was up 7.6% in the quarter, while the S&P 500 Index was up 8.1%. European assets are benefiting from continued dollar weakness, whereas the emerging market index is buoyed by the large AI-related weighting of Taiwan Semiconductor Manufacturing Company (TSMC) and China’s Alibaba and Tencent. Bonds also rallied with the Bloomberg Aggregate benchmark rising 2.4% as the Fed enacted a 25 bps interest rate cut in mid-September, with expectations for additional interest rate reductions over the next several months.

The market’s upward movement during July and August can be summarized by strong corporate earnings and a decline in tariff uncertainty. The S&P 500 Index led the way up 4.3% during the first two months of the quarter, and international markets and the tech-heavy Nasdaq enjoyed similar results.

The month of September saw a narrower market rally, dominated by news from the AI theme, including bold announcements from OpenAI that expanded partnerships with Oracle, NVIDIA, and AMD. Their initiatives will involve massive new computing capacity and complex equity investments to finance these future purchase commitments.

The month of September saw emerging markets and the Nasdaq both rising by more than 5%, while International developed markets were up 1.9%.

Chart 1: Markets Continue to Rise with AI Theme Leading the Way

Source: FactSet; As of 10/14/2025.

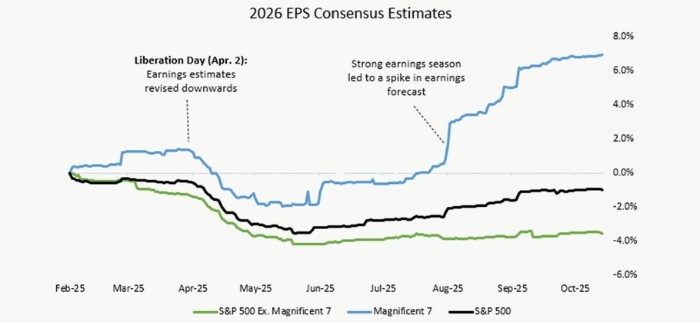

Since 2023, the Magnificent 7 companies have driven stock market returns for two reasons: 1) they have reported explosive earnings growth over these two years and 2) massive AI and datacenter spending is crowding out spending in other sectors of the economy. Earnings estimates for “Mag 7” stocks keep rising, whereas the estimates for the remaining 493 companies have not fully recovered from earlier tariff announcements. In short, the AI theme is propelled by strong current results, as well as significant optimism that AI will succeed in future deployment, even if conditions in the economy soften further.

Chart 2: Magnificent 7 2026 Earnings Growth Estimates Rebounded While the Rest of S&P 500 Did Not

Source: Bloomberg. As of 10/14/2025.

We see increasingly bullish investment announcements from AI participants in datacenters over the next 3-5 years. Longer term, we are concerned that this investment drive may be excessive and financed by debt and bad decision making, such as circular transactions in which NVIDIA buys an equity stake in its customers, muddying the basic tenet that sales should be “arm’s length transactions.” The chart below highlights that these companies are intertwined, making it difficult for investors to project a sustainable growth path.

Chart 3: AI Companies are Increasingly Inter-Related Blurring Traditional “Arm’s Length” Standard for Sales

Source: Morgan Stanley, Company filings and press releases; As of October 2025.

We are also nervous about the US Federal Government picking winners and taking equity stakes in companies rather than emphasizing its traditional role to ensure fair and transparent markets for multiple competitors.

There are other important drivers for the stock market’s rise, including the muted inflation impact of higher tariffs on customer prices and demand (so far). Though tariff rates are significantly higher than they were last year, the current customer impact is relatively low. According to the Yale Budget Lab, if current tariffs remain in place, the effective tariff rate would be 17.4%.

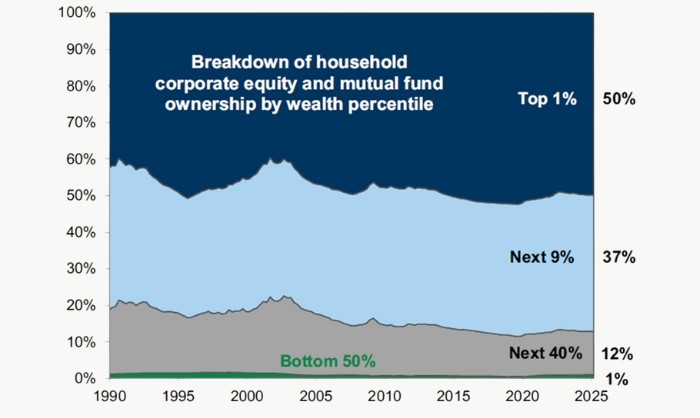

The Budget Lab calculates the GDP impact as -0.5% headwind on economic growth. This negative factor is not large enough to drive the economy into recession, but it will likely hurt the bottom half of household income. A different factor affects the upper half of household income. Overall, 50% of household consumption comes from the top 10% of households, and these households are significantly buoyed by the “wealth effect” of rising markets aiding discretionary spend. If investment markets continue to rise, wealthy household consumption will remain strong as tax cuts take effect in early 2026. However, the increased concentration of consumption makes the economy more fragile as a market pullback could lead to reduced consumption overall.

Chart 4: Top 10% of Households Own 87% of Stocks and Also Drive 50% of Consumption Creating a Link Between Market Moves and Overall Consumer Spending

Source: Federal Reserve, Goldman Sachs; As of October 2025.

Turning to the economic outlook, tariffs are inflationary, which makes it more difficult for the Federal Reserve to manage rising prices. We worry about the potential impact of inflation and investor confidence on the Federal Reserve and future monetary policy. The Fed recently cut interest rates by 25 bps and is guiding towards further rate cuts as labor markets soften. At the same time, the Fed lowered its unemployment forecast and raised its inflation forecast, which is counter to the logic of interest rate cuts. Right now, markets are seeing the Fed cuts as positive, and certainly in the near term, easier financial conditions are positive for stocks, consumers and corporations.

At the same time, however, the Trump administration wants the Fed to cut rates and is placing tremendous pressure on the Fed to control its decision making. The Fed Chairman Powell’s term ends in May 2026, and the new Fed Chair will be nominated by the President.

Central bank independence is a key strength of our current economic system. The Fed’s credibility to fight inflation while maintaining full employment requires it to make some tough decisions, which can be unpopular in the short term. Investors’ trust in an independent Federal Reserve board helps keep long-term inflation expectations anchored. This credibility helps explain why global investors view the United States as an investing safe haven, which leads to high demand for US Treasury debt and higher valuations for the US equity markets.

Globally, the data clearly indicate that countries with less central bank independence suffer from higher inflation and low investor demand. US history confirms the same pattern. The sustained inflation in the 1970s was spurred by the Fed Chair Arthur Burn’s decision to bend to President Nixon’s pressure to pursue expansionary monetary policy ahead of the 1972 election: Burns responded by cutting the Fed funds rate by 4% between 1970 and 1972.

This provided a short-term boost to the economy, but inflation spiked above 12% by 1974 and created a decade-long hangover of elevated inflation and poor stock and bond returns.

President Trump wants to cut the Fed funds rates another 3% toward 1%. The latest inflation figure of 2.9% is already above the long-term 2.0% inflation target for the Fed. Significant further cuts could damage Fed credibility and spark an inflationary cycle. We believe that political interference in central bank decision making is a key risk for 2026 and beyond.

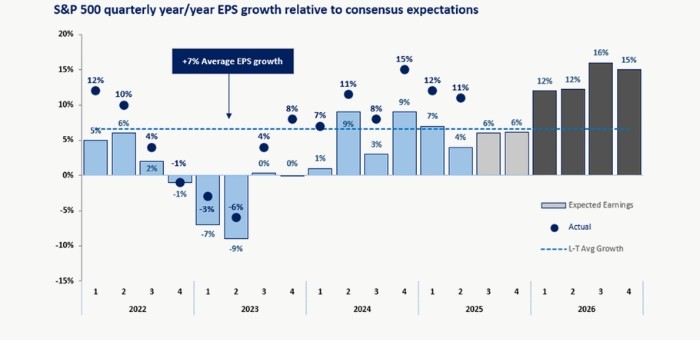

In summary, we remain cautiously optimistic about the near-term economy, but we worry about elevated valuations among AI companies and the attacks on Fed independence. There remain additional concerns regarding fiscal deficits and partisan politics, but we note that corporations, households, and state and local governments are generally in sound fiscal shape, which supports continued investment and spending in 2026. In addition, corporate earnings continue to grow and 2026 should also see lower tax tailwinds from the latest One Big Beautiful Bill fiscal package. For example, companies benefit from accelerated depreciation supporting earnings growth and capital spending. Importantly, it is hard to predict whether any particular factors might push the economy into recession over the next several months. We caution that equity valuations remain elevated and the current 2026 earnings expectations of 13% growth are far above the long-term average of growth in actual earnings and are therefore vulnerable to downward revisions.

Chart 5: 2026 Expected Earnings (dark grey) Well Above Long Term Average

Source: FactSet; As of 9/30/2025.

As we assess the outlook for risk and reward in investment decisions, we will continue to probe for cracks in the AI investment boom and monitor any further weakening of central bank independence. We look forward to hearing from you and updating you on your portfolio and on our outlook for the next year. Please reach out with any questions.

Best regards,

The Choate Wealth Investment Team