2025 brought many surprises and whipsawed investors: tariffs and AI concerns shook market confidence early, and the S&P 500 Index was down 15% for the year on April 8 . Yet, AI confidence strengthened and markets surged in the second half. Over the course of the year markets recovered, ending the year with the S&P 500 Index up 17.9% and the MSCI All Country World Index (ACWI) increased by 22.9%, while the Bloomberg Aggregate Bond Index rose 7.3% by the end of the year.

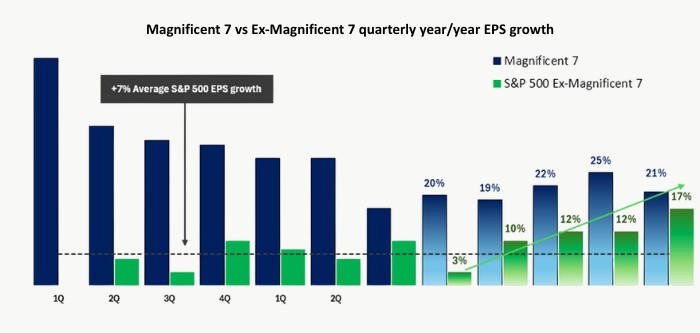

Consumer spending and corporate earnings remained very strong, and GDP growth accelerated, fueled by continued AI investment spending. S&P 500 earnings likely rose 12% in 2025 and 2026 earnings estimates are expected to increase by 13.5%, much of this fueled by AI-themed stocks. However, we are encouraged that earnings growth is also picking up for the “other 493” S&P stocks (see chart below).

Chart 1: Earnings Picking-Up for Non-Mag 7 Large Cap Companies

Strong international performance stemmed from 1) dollar weakness and 2) a recovery in emerging markets, spurred by such large AI companies as Tencent and Taiwan Semiconductors.

We remain cautiously optimistic about 2026 GDP growth. Announced AI capital spending, lower interest rates and fiscal stimulus from increased tax refunds, and accelerated depreciation should support continued growth early in the year.

Structural economic and geopolitical concerns remain, but the strong current earnings momentum should support high stock valuations and may push these problems toward the midterm elections and 2027 risks.

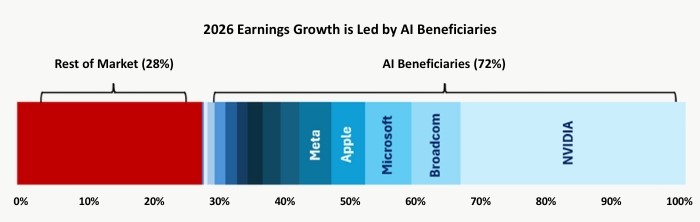

The AI investment theme is central to corporate earnings growth and high stock market valuation. 34% of the estimated 2026 S&P 500 earnings growth is from NVIDIA alone and roughly 72% of overall S&P 500 earnings growth stems from the narrow AI beneficiaries listed below.

Chart 2: AI Stocks are Key to Overall Earnings Growth

Semiconductor companies, like these AI beneficiaries, historically are quite cyclical. Market expectations assume that the investment boom will continue, fueling significant momentum heading into 2026, but concerns remain regarding the massive costs and unclear benefits from building out this new technology infrastructure.

Much of the current data center growth is dependent on the Large Language Model (LLM) companies (OpenAI, Anthropic, and Google’s Gemini model), which are the expected cornerstone of future AI adoption. However, both OpenIA and Anthropic are cash flow negative and racing to build out their computing platforms, and it is not clear how these applications will eventually be profitable. As the DeepSeek threat last year demonstrated, China’s approach utilizes more tailored Small Language Models and may end up being more effective.

Therefore, it is difficult to assess what the eventual data center spending and return on investment will be. We worry that an increasing amount of data center construction is now financed by debt. Bloomberg calculated over $176B of credit deals for data centers alone last year and estimates that Hyperscaler capital expenditures will peak in 2027 (up only 4% from 2026) before declining.

The AI theme affects 1) the US stock market – dominated by companies such as NVIDIA, Broadcom, Microsoft, and 2) emerging markets – where Tencent, Samsung, Taiwan Semiconductor, and AliBaba are the largest weights. In addition, ~50% of venture capital investing is flowing to AI, and with OpenAI valued at $500B and Anthropic at $300B, some frothy speculation is tied to AI excitement. If there is future disappointment or delay in the anticipated AI rollout, this could lead to sizable market declines, which would ripple through the economy and negatively affect corporate and consumer spending.

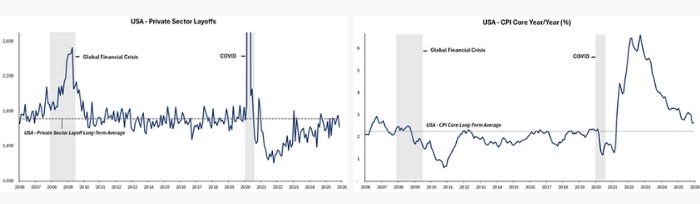

We are watching labor markets closely as a barometer for the economy’s health. The 4.4% unemployment rate is rising but remains low. Job growth has slowed, but layoffs remain very low, so labor pressures seem balanced for now.

Chart 3: Layoffs are Well Below a “Recession Level” and Lower Inflation Gives the FED Some Breathing Room

Inflation is slowing but still above the Federal Reserve’s long term 2% target. While the FED’s independence has anchored long term inflation, the next FED Chair will be under tremendous political pressure to slash interest rates, and its independence is being tested by the Trump presidency.

There are always clouds on the investment horizon. We underline the eventual impact of a “broken” federal budget process with high structural deficits and a Federal Reserve under increasing political pressure, and we worry about the Trump Administration’s confrontational domestic and foreign policy, as geopolitical tensions remain very high. Consumer sentiment remains poor and less affluent households are struggling with the “affordability” of key consumer goods, such as housing, groceries, and insurance. Income inequality continues to rise. It is an increasingly narrow slice of US wealthy consumers that support economic consumption.

Still, the US economy is stubbornly resilient, and near-term earnings growth looks favorable, thanks to a narrow band of AI behemoths. Long term GDP growth will likely need to stretch to other sectors and less wealthy consumers if we are to avoid a bursting AI bubble or a recession.

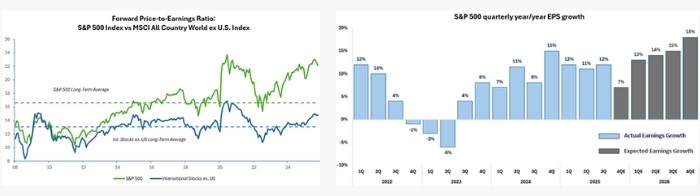

Chart 4: US Stocks Trade at a Significant P/E Premium to the Rest of the World Buoyed by Recent Earnings Growth

Long-term earnings growth in the US averages 7%. In recent quarters, growth has been much higher and the consequences are set out in two charts above. On the right, we see the rise in earnings of large US companies. On the left, we compare US stocks to non-US stocks. The US Price to Earnings (P/E) multiple is currently elevated as compared with its own long term history and as compared with international stocks (ACWI ex US). Over the last decade, US earnings grew faster than ex-US earnings, and US P/E multiples expanded relative to the multiple for international stocks. We think US multiples will stay high only so long as NVIDIA and others continue to grow earnings more rapidly than their international counterparts. If the earnings of US companies grow more slowly, this will leave US stocks vulnerable to a significant decline and compression of the P/E multiple.

The next year poses several investor questions: What does the new FED Chair mean for inflation? How will partisan politics affect the Federal budget and deficit issues? How will we navigate the aggressive transactional policies of this Administration ahead of the November elections? Can consumer and corporate spending continue to defy tariff and labor concerns? Investors should remain focused on changes in economic data, since valuations are elevated and current markets seem highly optimistic.

We look forward to hearing from you and updating you on your portfolio and on our outlook for the next year. Please reach out with any questions.

Best regards,

The Choate Wealth Investment Team